A proforma invoice is an invoice in the case of which a prepayment is requested prior to the goods/services being issued.

- Inventory goods added to proforma invoice do not reserve them nor do they reduce stock. Thus allowing inventory goods to be added to proforma invoice even if those goods are not yet in stock.

- Saving proforma invoice does not create financial transaction. Financial transaction is created upon binding with proceeding and on the date of proceeding. In case of partial proceeding financial transaction is created only in the sum of proceeding.

- Default proforma invoice percent is initially 50%. Default percent, proforma invoice number formula and document template can be changed to your liking under environment settings.

To create proforma invoice choose Proforma invoices from Operations menu and click on green “New proforma invoice” button.

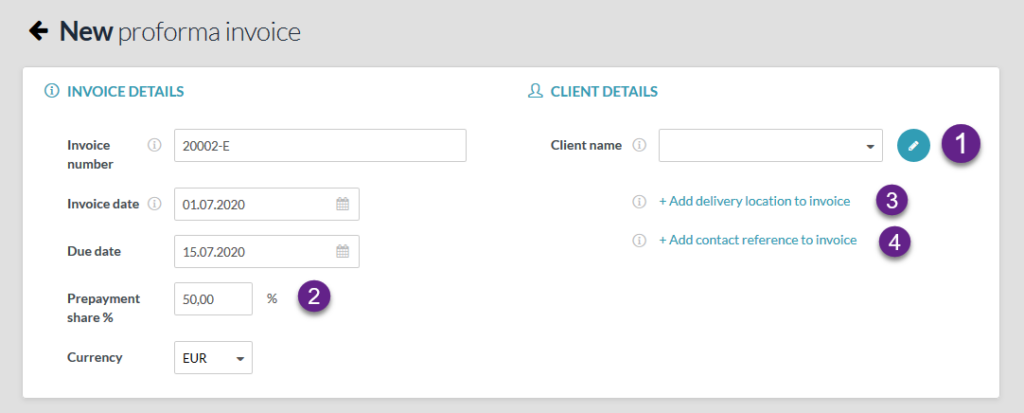

1. Choose client or create a new one

2. Check that proforma invoice percent is correct

3. Choose delivery address if necessary

4. Add contact details if necessary

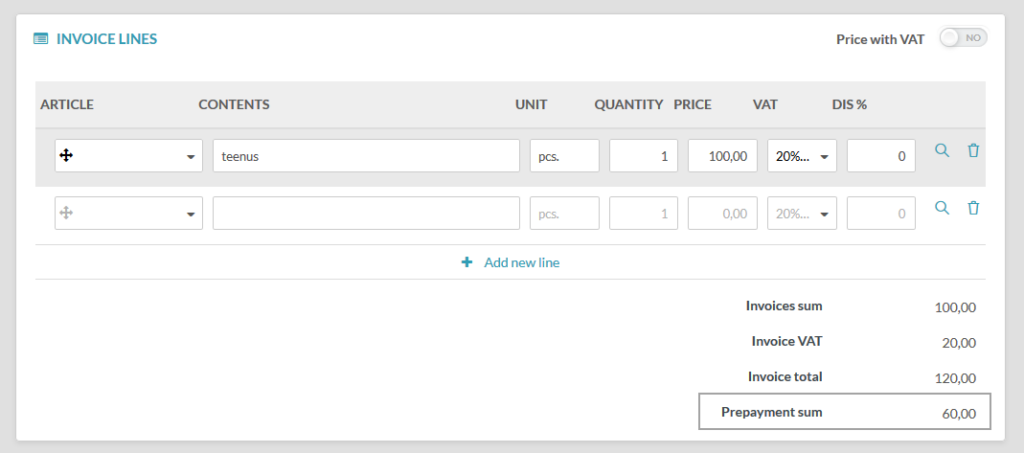

Adding and filling of proforma invoice rows works similarly to regular sales invoices rows. You can read more about this in the Sales invoices – settings and how to create manual.

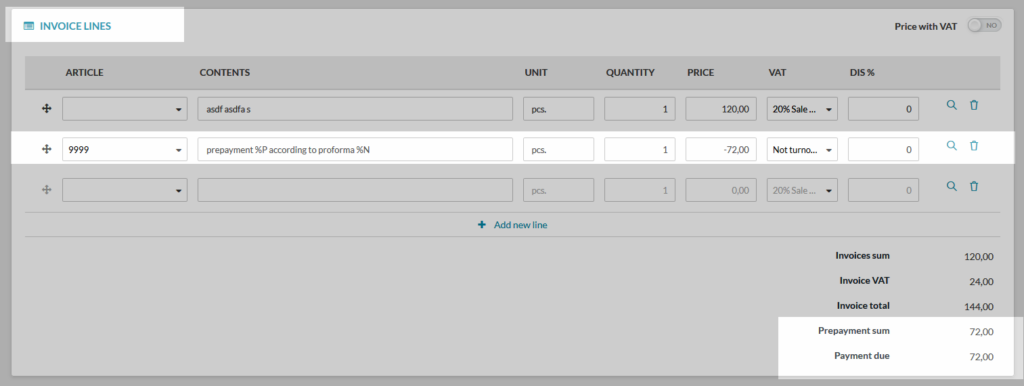

Difference from sales invoices is that payable prepayment sum is also shown on proforma invoices after total sums.on proforma invoices.

Proforma invoice can be sent to client e-mail from Operations menu by clicking on Send out proforma invoice link.

When prepayment comes in then it can be bound to proforma invoice either by clicking on Mark as paid under Operations menu or via bank import.

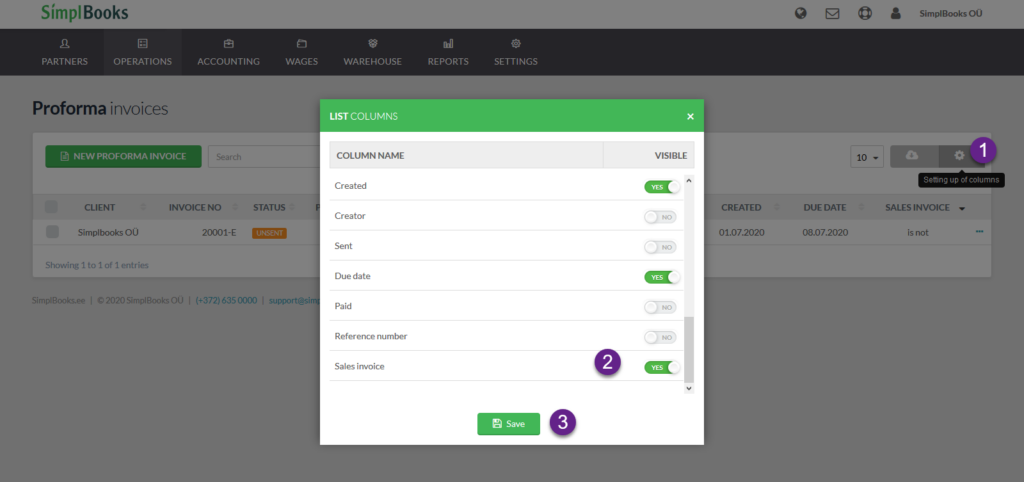

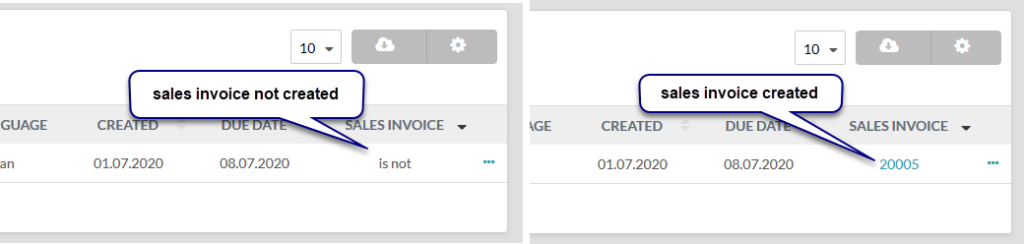

To have a better overview which proforma invoices have been converted to sales invoices we suggest making “Sales invoice” column visible in the proforma invoices list. If no sales invoice has been created for a specific proforma invoice then “is not” is shown. Otherwise sales invoice numebr is shown.

To create sales invoice from proforma invoice open specific proforma invoice and choose Prepare a sales invoice from a proforma invoice from Operations menu.

Sales invoice is then created that includes a minus row with prepayment article that is deducted from the invoice total sum. That row must not be removed from the sales invoices.

Sales invoice financial transaction takes prepayment sum into account and sales revenue row sum in transaction is reduced by prepayment (prepayment sum has already been added to sales revenue earlier on the proforma invoice).

Leave A Comment?