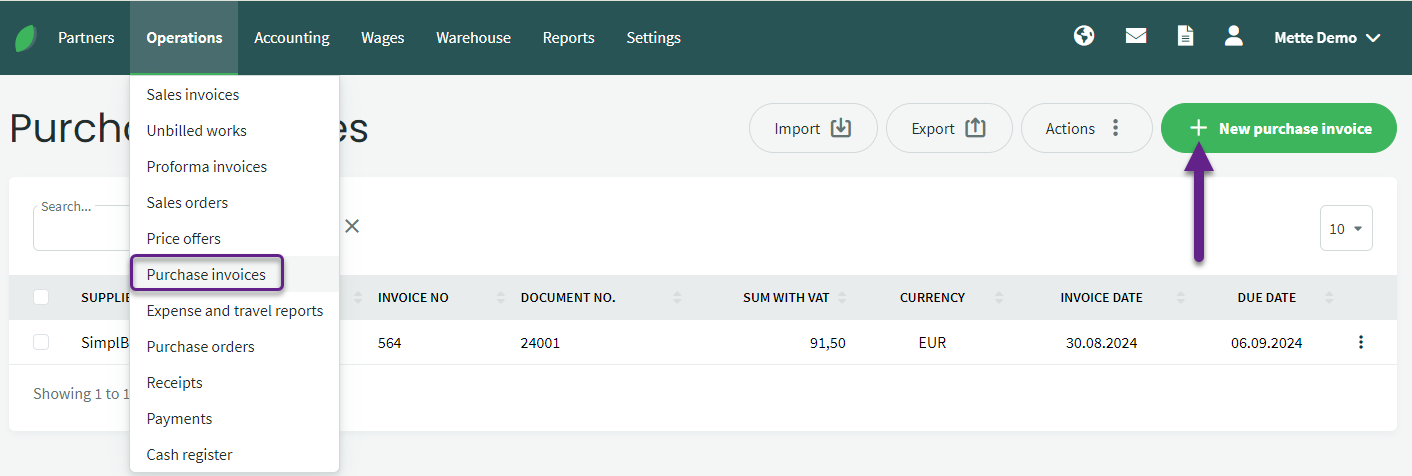

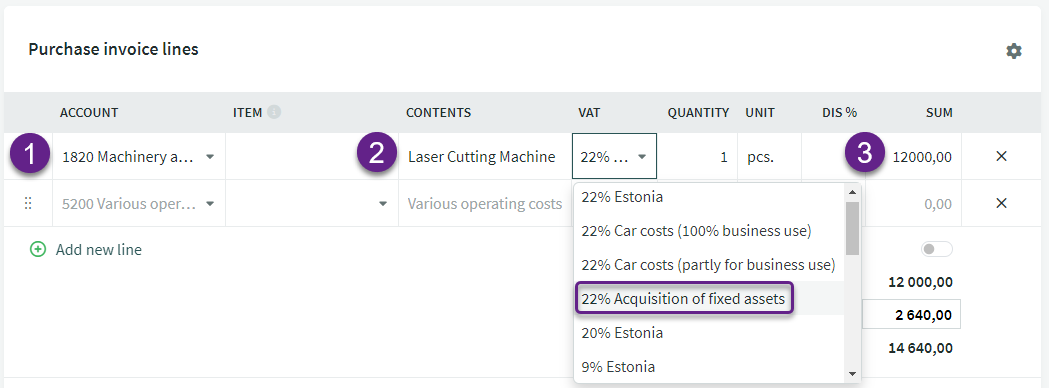

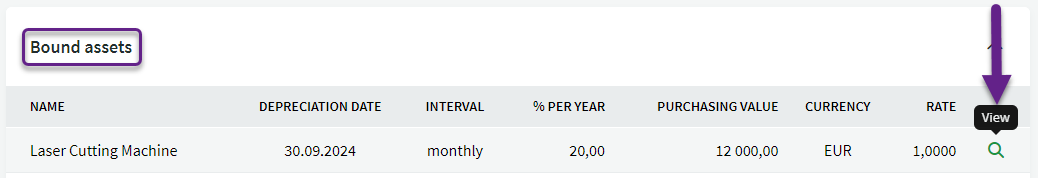

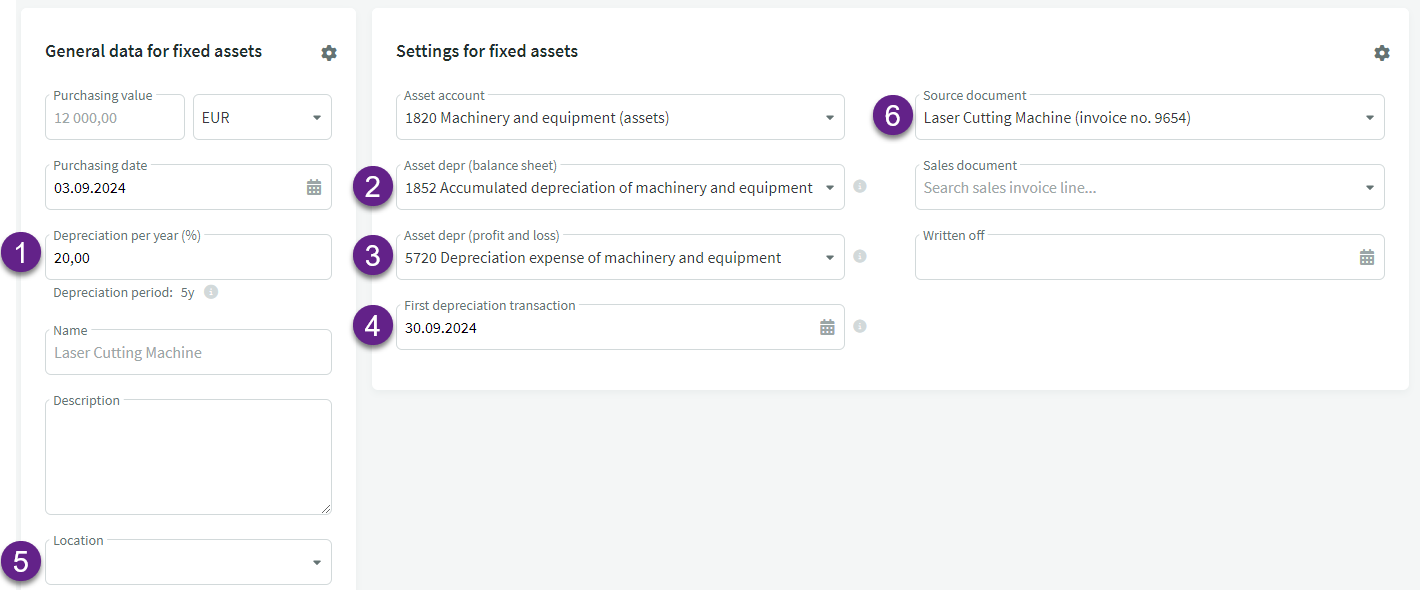

Fixed assets acquired during the use of SimplBooks software should be recorded through a purchase invoice. An exception applies in cases where it may be necessary to combine the value of a fixed asset from multiple purchase invoices. In such cases, it might be more beneficial to create a separate fixed asset card.

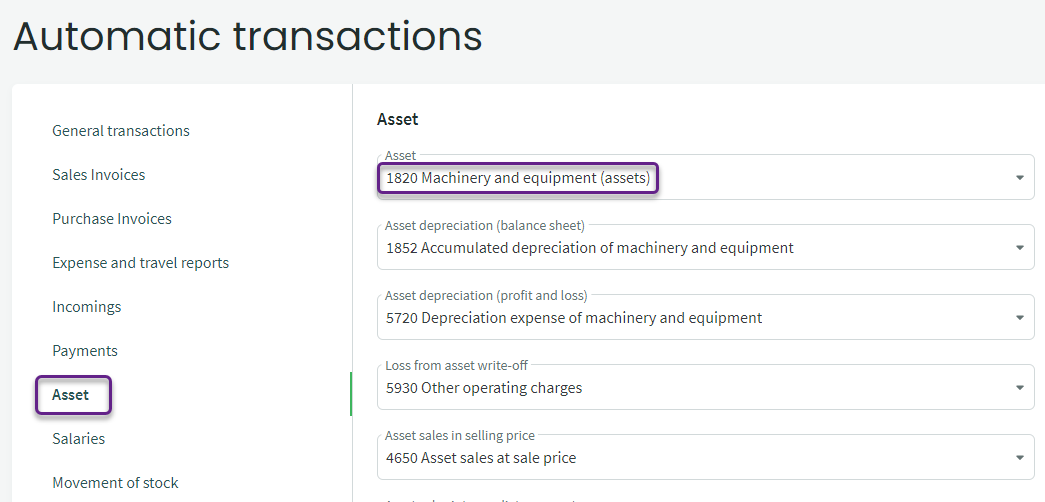

● Existing fixed assets acquired before joining SimplBooks can be recorded according to the guide: How to Transfer Existing Fixed Assets to SimplBooks?The rules for depreciation accounting (when depreciation starts, how frequently expense entries are made) can be configured under Settings -> Environment Settings -> Fixed Asset Settings. These settings should be reviewed before entering the fixed asset purchase invoice.

For additional questions, please write to us at support@simplbooks.ee.

Leave A Comment?