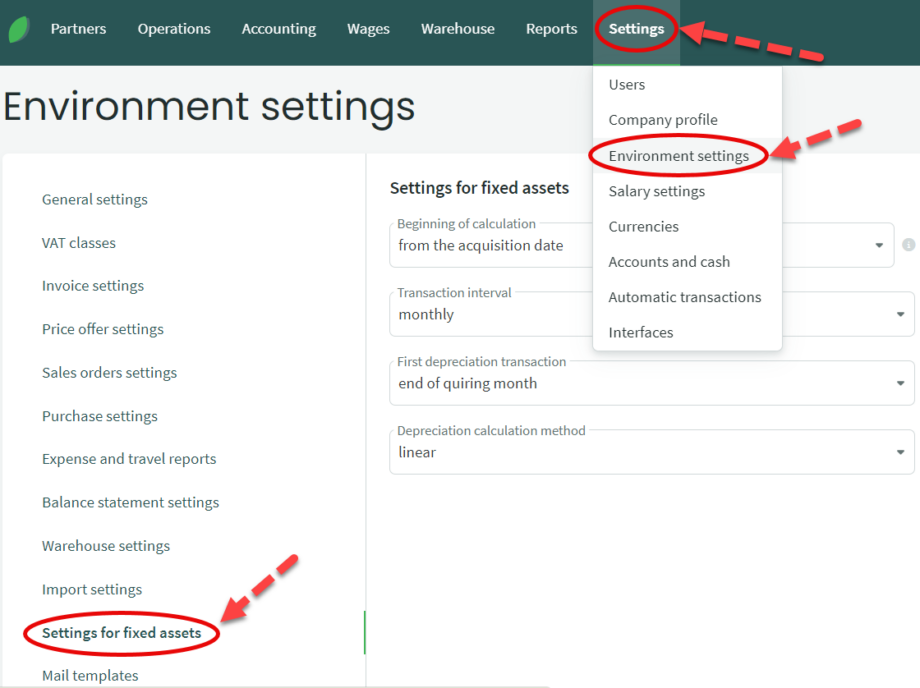

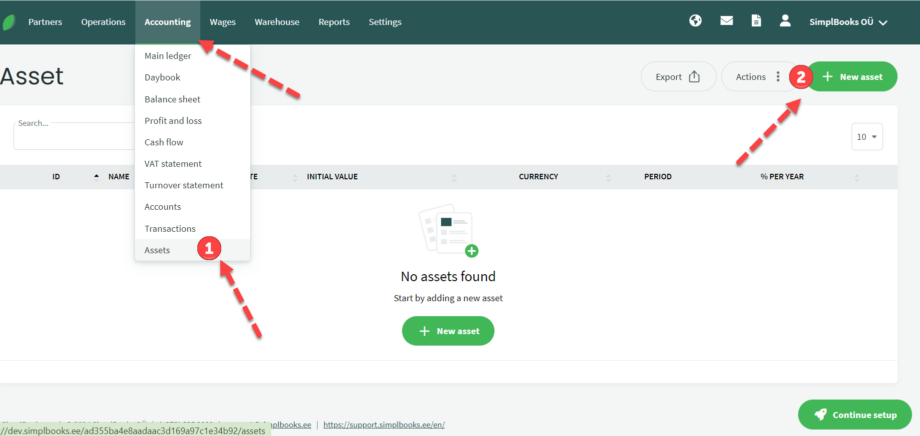

To enter a fixed asset card, go to: Accounting -> Fixed Assets -> New Fixed Asset

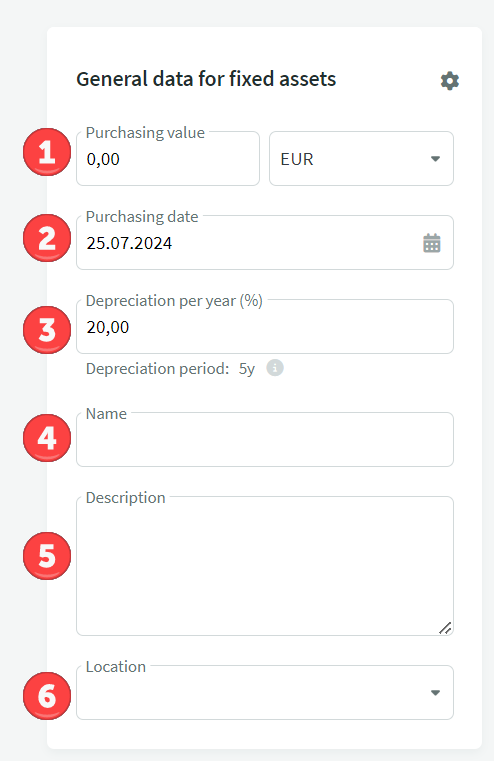

● General Information of Fixed Assets1. Purchasing value – actual purchasing value (not including VAT)

2. Purchasing date – actual past date of purchase

3. Depreciation per year – annual percentage of depreciation of asset; on the basis thereof the programme divides depreciation in proportion to the years of usage.

For example: 20% = 5 years; 100% = 1 year; 10% = 10 years.

To change the depreciation period you must adjust the depreciation rate.

4. Name – name of asset

5. Description – necessary additional information concerning the asset

6. Location – a free-text field for adding the location of the fixed asset (e.g., the person responsible), and it can also be used for grouping purposes (e.g., machines and equipment, other fixed assets).

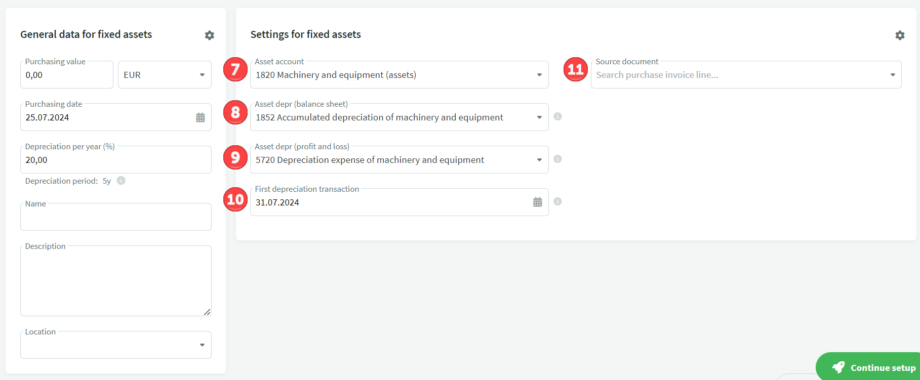

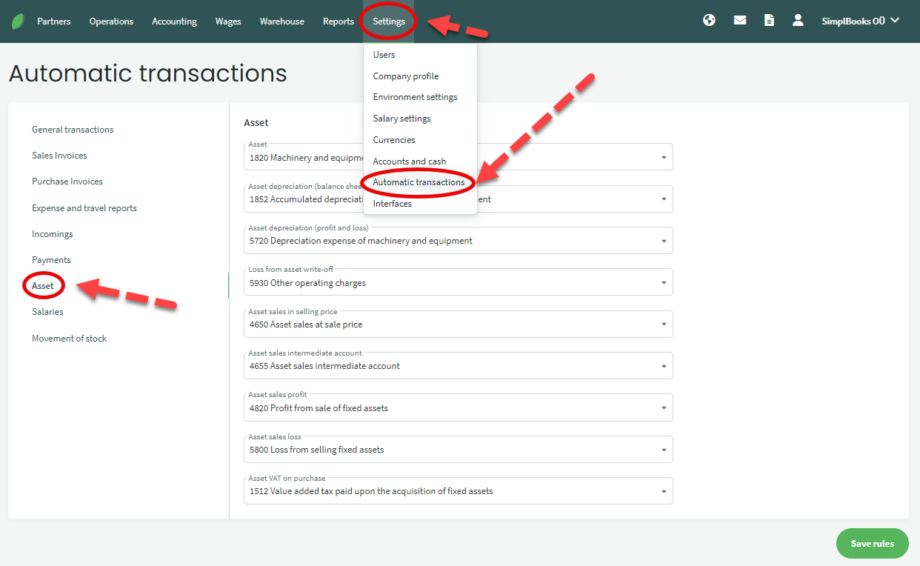

7. Asset account – corresponding financial account

7. Asset account – corresponding financial account

8. Beginning of calculation – the choice is between two options: from the purchase date and from the beginning of the calendar month. The first calculates depreciation from the purchase date and the second from the beginning of the calendar month.

9. Transaction interval – the interval at which the depreciation transactions are automatically calculated: monthly, quarterly or annually; choose the most suitable one.

10. First transaction – the date of the first transaction must be the date of the first depreciation transaction (not the first transaction in SimplBooks).

Finally, click on “Save asset”.

If everything is correct, the system will calculate the residual value.

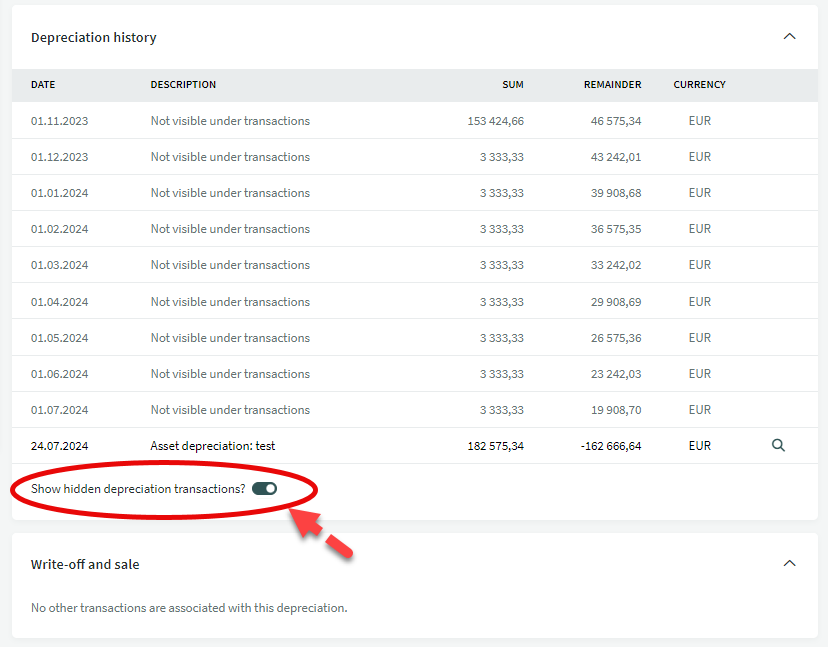

Depending on the price of the fixed asset and the calculation methods of different software, there may be some discrepancies in the residual value. To align the residual value of the fixed asset with previous accounting, adjust the first depreciation entry made by SimplBooks (increase or decrease as necessary).

● Adding a fixed asset card does not create financial entries. The acquisition cost and accumulated depreciation of the fixed asset must be recorded in the initial balances entry on the required accounts.Does the asset amount add up?

- The correctness of the balance can be checked by selecting Accounting -> Balance and setting the date of the initial balances as the date.

- You can also select Reports -> Assets report and set the same period.

Leave A Comment?