SimplBooks offers several options for entering salaries – it can be done one by one or for all (or selected) employees at once. If you opt for the latter you should definitely set the employees’ salaries and applicable taxes on their information sheet beforehand.

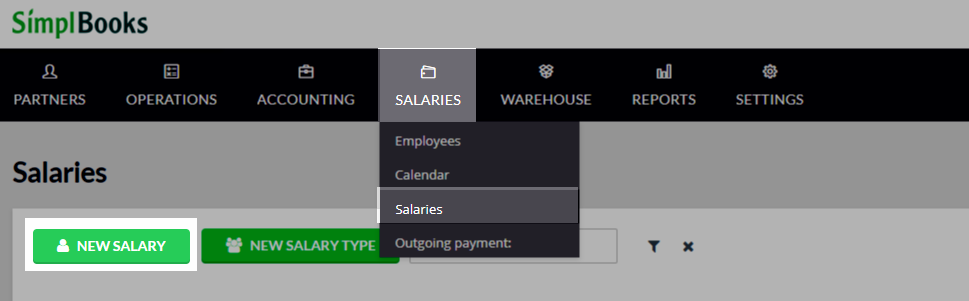

This manual only focuses on entering salaries one by one and the options it includes. To enter a new salary, open from the main menu “Salaries -> Salaries” and then click on the button “New salary” in the upper left corner.

It opens a view consisting of four sections: general details, salary parts, withholdings, and taxes and consolidated information. Let’s have a look at each section.

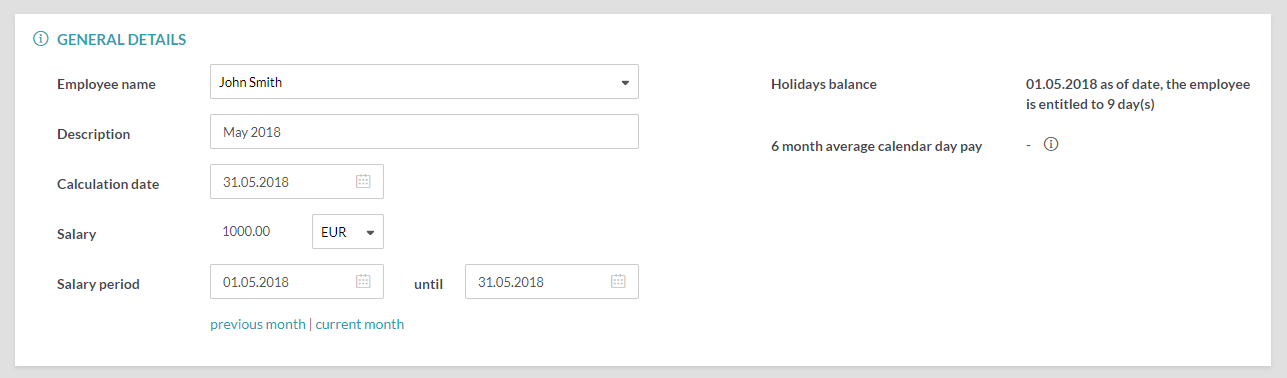

General details

First you should select the employee whose salary you are going to calculate and the period for which the salary is to be calculated along with the calculation date. By default the period is the current month and the calculation date is the today’s date. When the employee has been selected, the active salaries associated with the employee and any calendar events concerning the employee within the selected period are displayed. The salaries and calendar events are reloaded if the calculation period is changed. In addition, the holidays balance at the beginning of the calculation period and the 6 month average calendar day pay are displayed on the right in the general details section. The information button to the right of the average calendar day pay displays the information which serves as the basis for calculation.

The 6 month average calendar day pay IS NOT displayed if no salary has been entered for the employee during 6 months prior to the selected period.

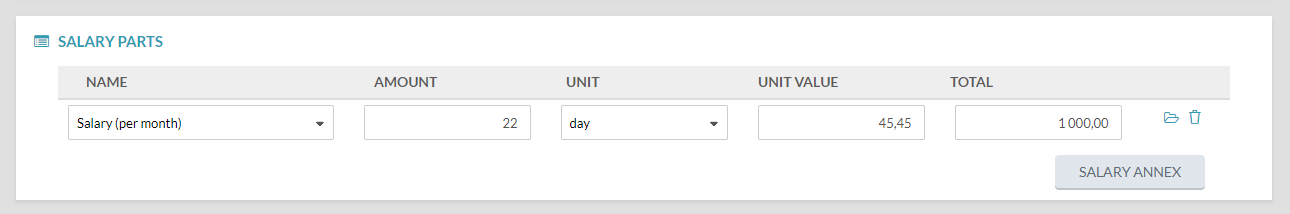

Salary parts

If the general details are in place, you can still adjust the salary parts, if necessary, and manually supplement them. For example, add additional remuneration. Let it be said that if you do not add holiday pay to the calendar but merely add it directly to the salary, the amount of holiday pay is not automatically calculated and it is not properly taken into account in the calculation of the holiday pay of future periods.

In the salary parts section you can also set out the hours worked if the employee’s salary is calculated on the basis of hourly wage. No working time schedules can be prepared in SimplBooks but the system can create a working time report which summarises hours, if necessary.

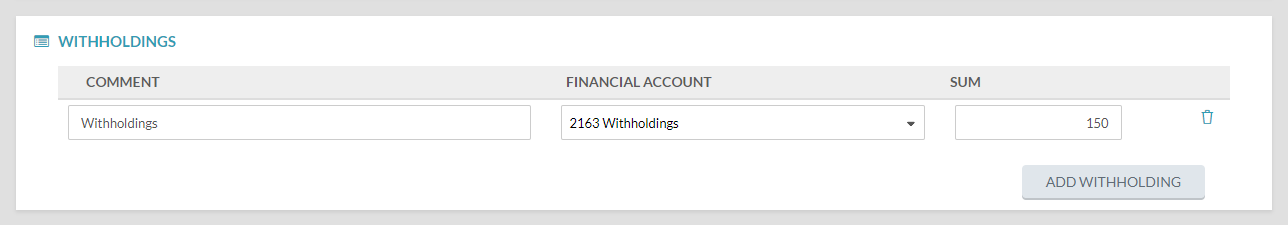

Withholdings

Here you can set various withholdings from the employee’s salary. Amounts are withheld from the employee’s net salary and they are transferred to the financial account in accounting determined by you. The default withholdings account can be set by selecting “Settings -> Automatic transactions -> Salaries” and determining the account under “Withholdings from salary”.

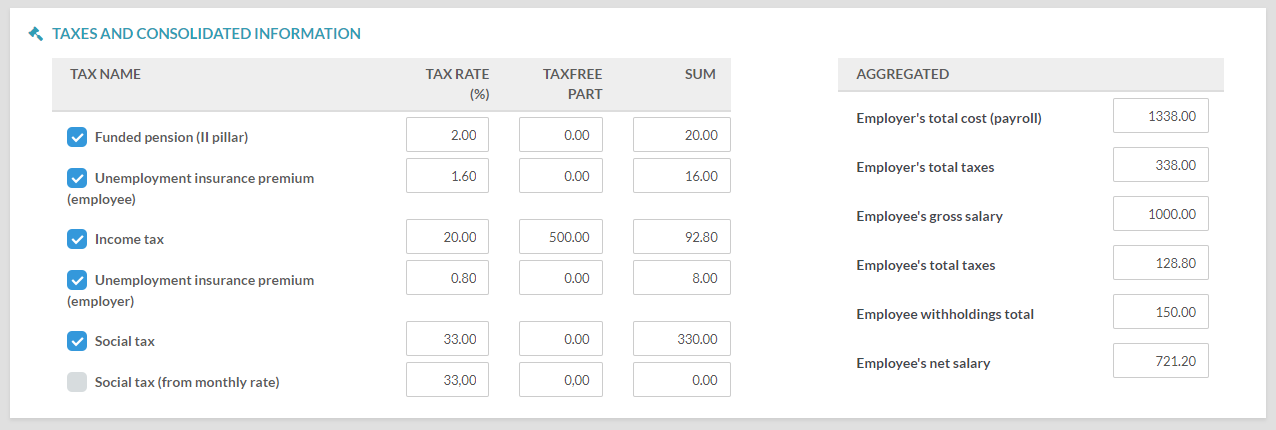

Taxes and consolidated information

In the last section you can once more review the taxes applied to the employee’s salary. If necessary, the applicable taxes can still be adjusted in annexes or you can uncheck the relevant taxes. You can also set the tax-free part (e.g. income tax) and the tax rate (e.g. funded pension) here at the so-called last minute. We recommend using the employee information sheet to set the taxes for the purpose of avoiding constant manual adjustment of taxes.

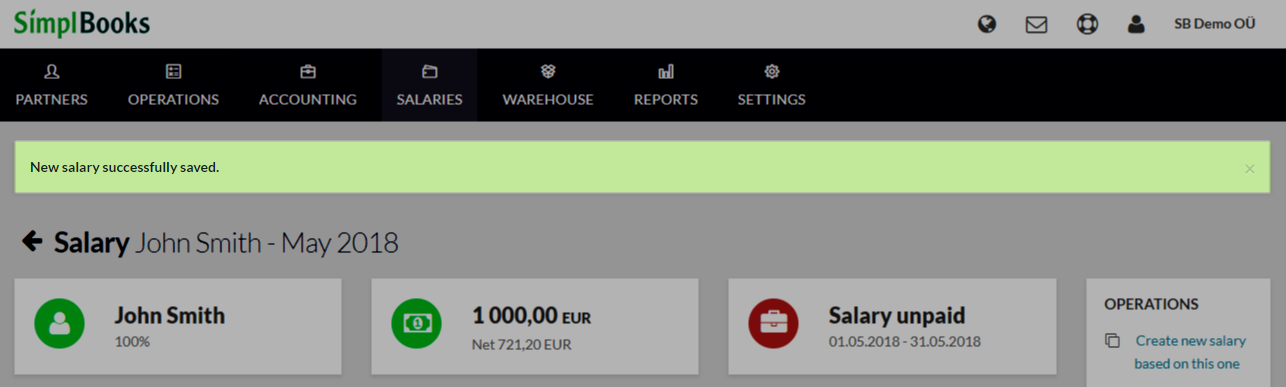

The consolidated information table simply displays the general salary numbers, such as the net salary, gross salary and payroll. After you have checked the taxes and consolidated information you can save the salary.

Leave A Comment?