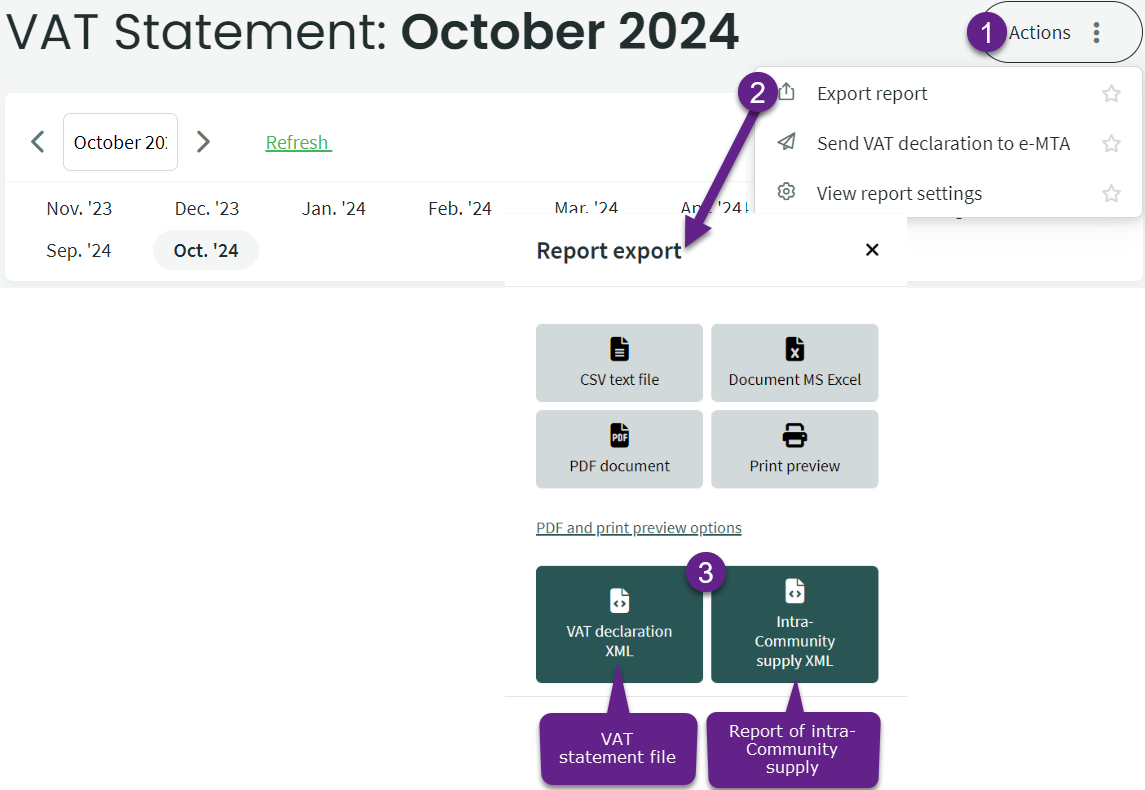

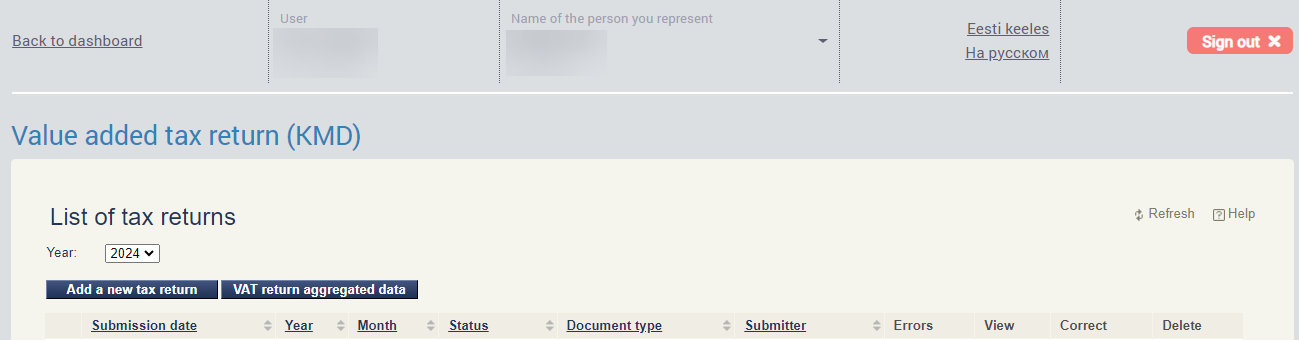

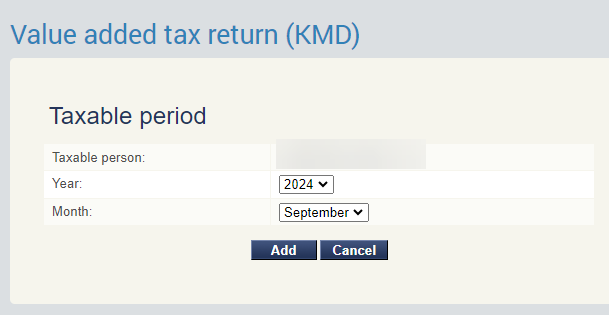

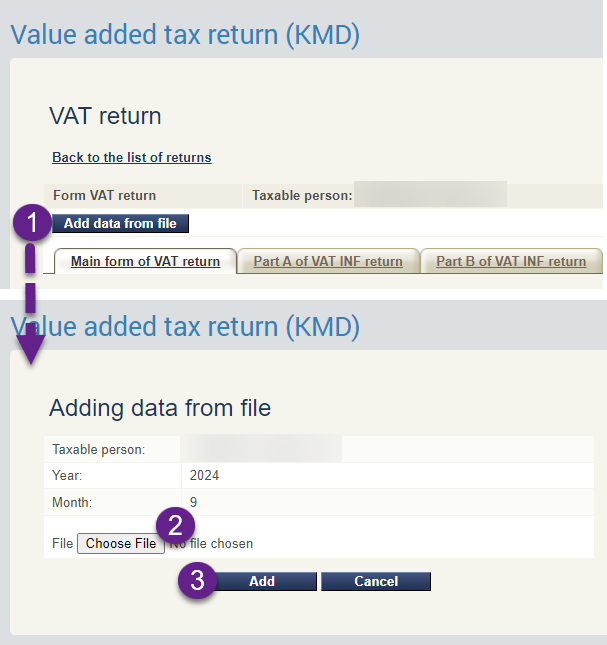

The VAT report (KMD) and annexes INF A and INF B can be exported from SimplBooks software as an XML file and imported into the Tax and Customs Board system.

Before exporting the file, review the data. If necessary, you can remove inappropriate lines from the INF annexes before exporting the transactions. To do this, simply uncheck the box in front of the inappropriate line, and those data will not be included in the report.

In KMD INF A (sales invoices) and INF B (purchase invoices) annexes, you must declare the transactions of the corresponding month that exceed 1000 euros (excluding VAT) per transaction partner. Transactions with individuals are not included in the INF annexes.

Leave A Comment?