Transactions can be entered in two ways:

- Manually under Accounting -> Transactions

- Via bank import

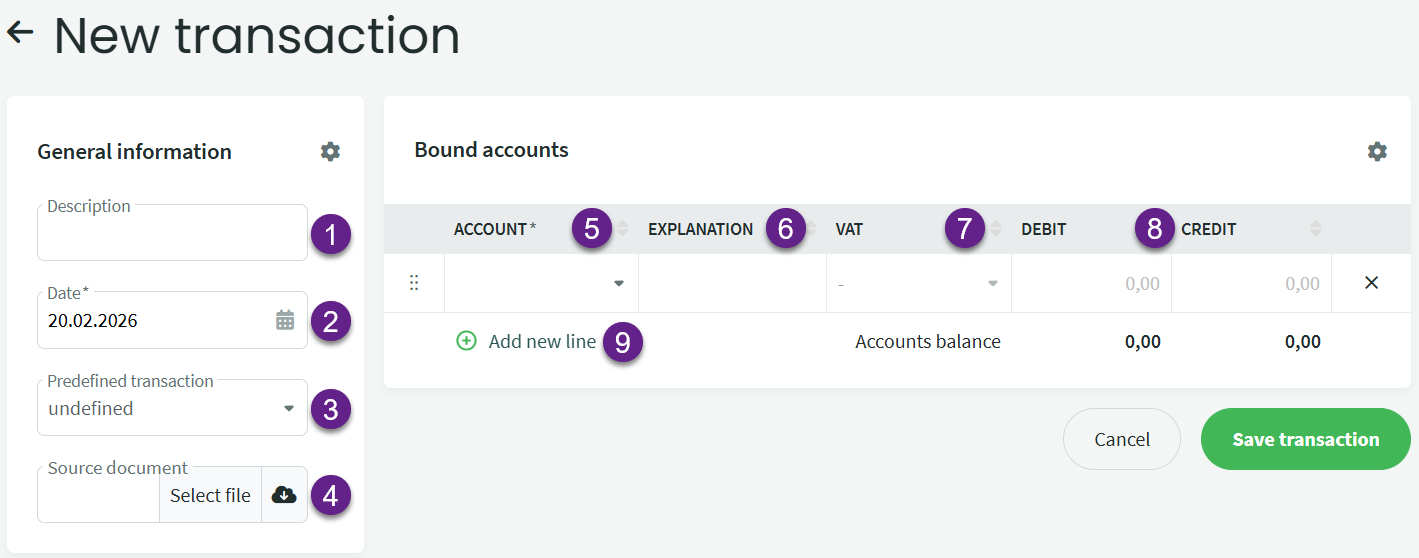

Accounting -> Transactions -> New transaction

- Description of the transaction shown in the transaction list

- Date when the transaction occurred (not necessarily the same as the entry date)

- Predefined transactions allow you to specify the accounts used in the transaction and are convenient when you often need to make entries with the same accounts.

- You can add a document as a source document by uploading a file from your computer (select file) or from the imported documents (cloud icon).

- Choose the appropriate account.

- Additional information can be added in the explanation field.

- The VAT type is automatically filled in for sales and purchase invoice entries; otherwise, it remains empty. If you manually enter a sales-related transaction, you must also specify the VAT type. Otherwise, the transaction will not be included in the VAT statement.

- Debit/Credit amounts.

- Adding a new line. Each transaction must have at least 2 lines.

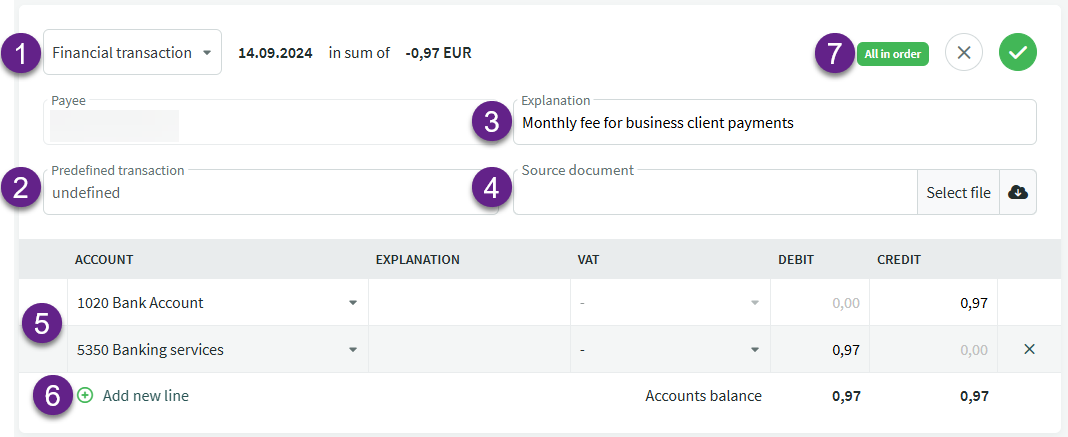

If bank transactions have been imported but are still unprocessed, it is possible to change the type of transaction. Depending on whether it is an income or expense transaction, different options are allowed.

The system generally recognizes bank service entries and can immediately suggest an expense account:

- Transaction type that can be changed by clicking the arrow.

- Selecting a predefined transaction.

- The description is automatically filled with the information received from the bank (when using a predefined transaction, it will overwrite the description of the predefined transaction).

- You can add a source document as a supporting document by uploading a file from your computer (select file) or from the imported documents (cloud icon).

- The first row is filled with the bank account information received from the import, and this row cannot be changed.

- If necessary, you can add more lines to the transaction to allocate the bank amount.

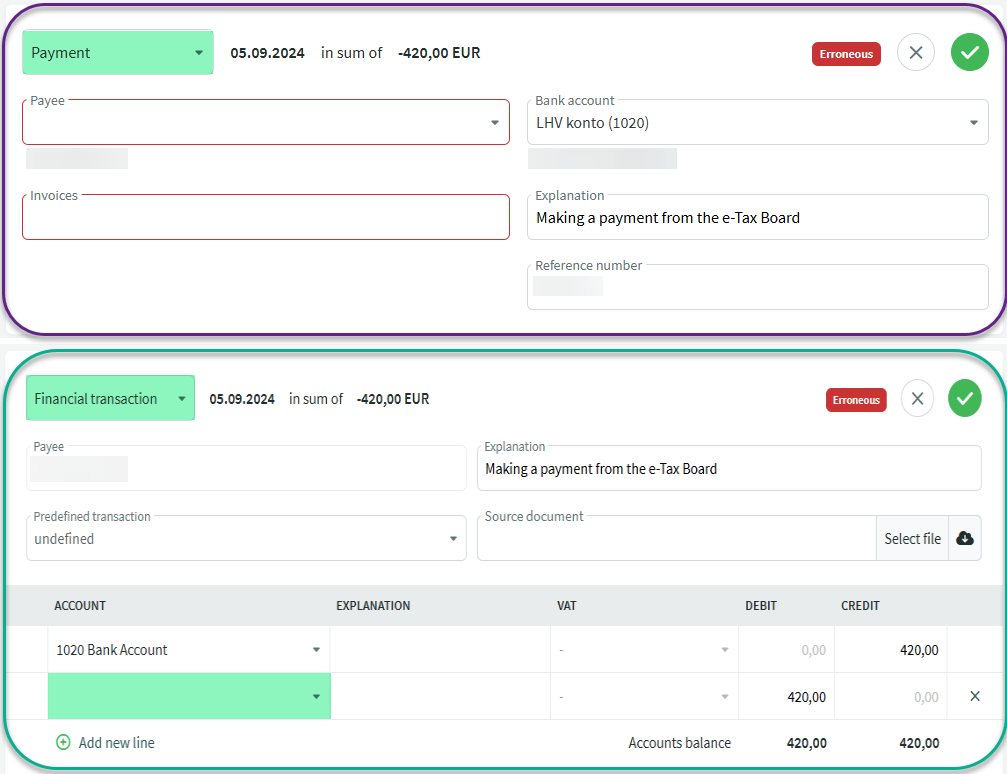

The following image shows an example where a transfer made to the Tax and Customs Board comes in with the type “Payment,” but we will change it to the type “Financial Transaction.” For the second account, select account 1520, the Tax Prepayment account.

The transaction should be saved this way when paying VAT or when paying fringe benefit tax separately from payroll taxes.

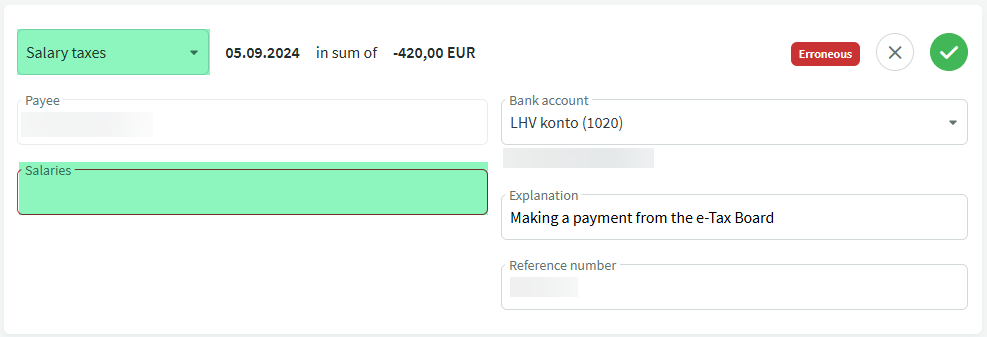

When paying payroll taxes, you must select the type “Payroll Taxes.”

By clicking in the “Salaries” field, you must select the salaries for which the taxes were paid. The account 1520, the Tax Prepayment account, is used in the entry, and the entry for closing the payroll tax liabilities is saved under the month of the tax payment in the TSD report.

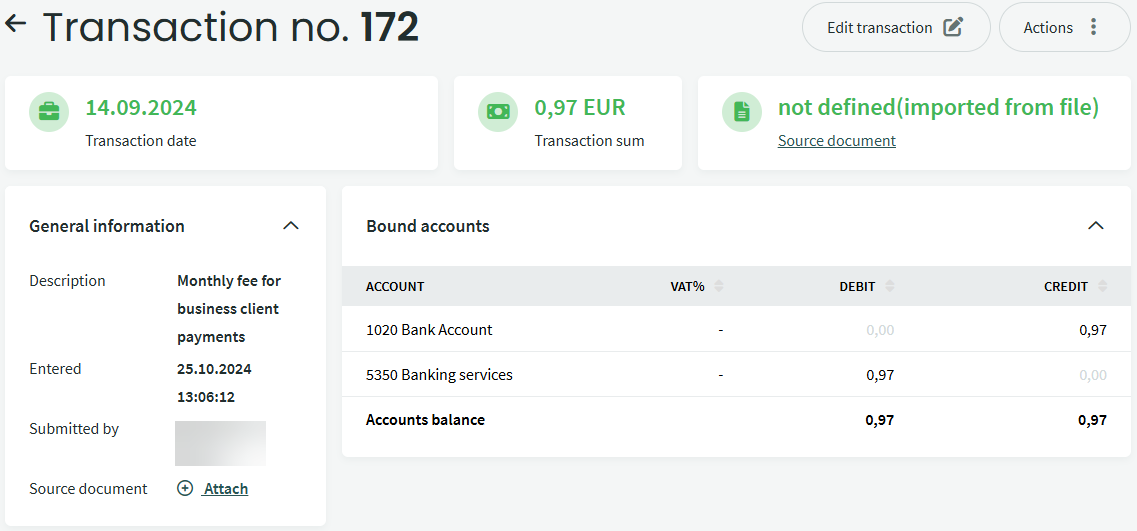

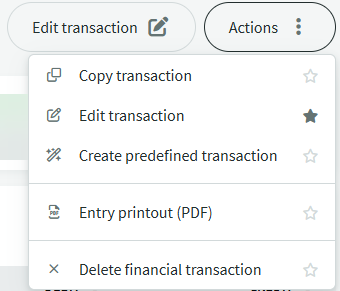

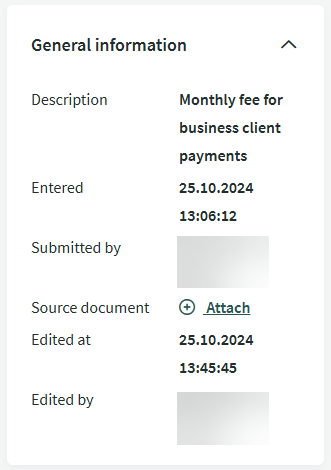

To change a transaction or make a copy of it, click on the desired entry in the transaction list.

When you hover over the Actions menu button, you will see options. Here, you can also mark two of your most frequently needed activities as favorites.

After changing a transaction, the change time and the person who made the change are visible under the general information of the transaction. If a transaction has been changed multiple times, only the information about the last person who made the change is displayed here. More information about user activity history can be found under (Settings -> Users -> User action log).

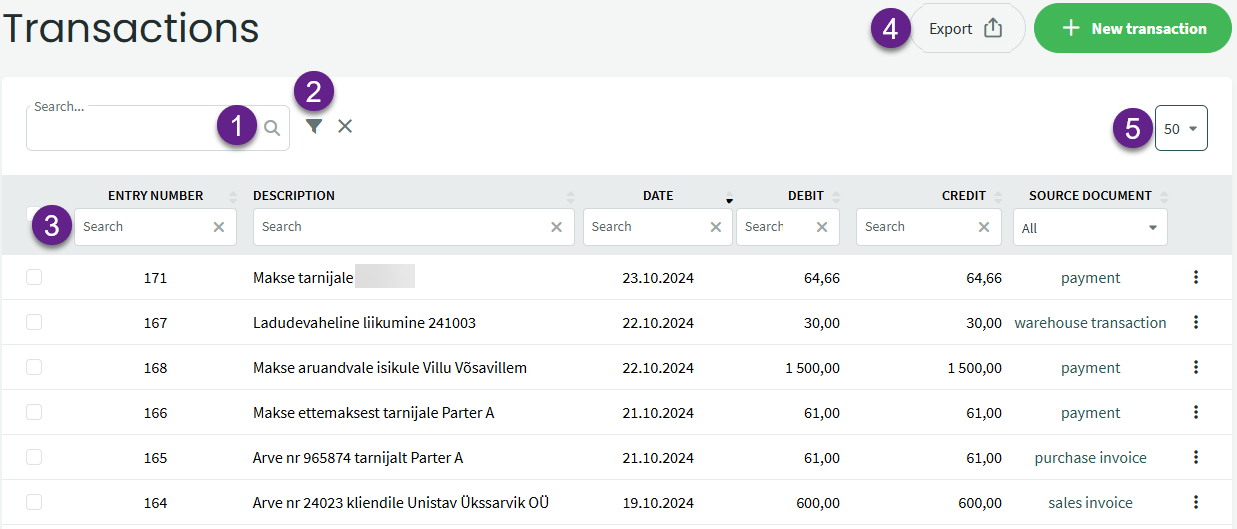

- General search box

- Advanced search filter and button to clear all filters

- When the advanced search filter is activated, search boxes are added above all columns.

- Options for exporting the transaction list (various formats)

- Changing the length of the list

In the date advanced search field, you can filter as follows:

- For the entire month, write the month + year (03.2024)

- To search for the entire year, simply write the year (2024)

- By writing 01.01.2024-, transactions from 01.01.2024 will be searched

- By writing -31.12.2024, transactions up to 31.12.2024 will be searched

The text in the source document column provides information on which source document the transaction is based. For transactions manually added or saved as a transaction from bank import, this column will show “MISSING,” indicating that it is a separately created entry.

When deleting a transaction without a source document, the deletion is permanent and cannot be restored.

If the transaction was created based on a source document, it cannot be deleted directly; instead, the source document must be deleted first, which will then also delete the transaction in the system.

You can find various transaction examples in the guide “Frequently Used Accounting Entries.”

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?