NB! If your company is not registered for VAT (value added tax), you cannot show VAT on sales or purchase invoices, nor you do need to record or declare VAT.

Also, make sure to mark this in the Company profile.

Also, make sure to mark this in the Company profile.

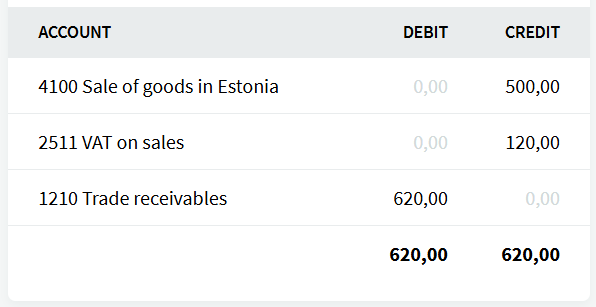

Output VAT is recorded on sales invoices, which represents the tax liability to the Estonian Tax and Customs Board.

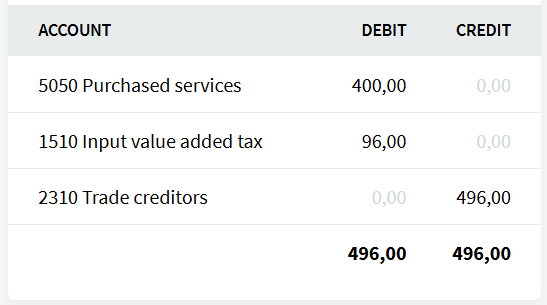

Input VAT is recorded on purchase invoices and can be reclaimed from the Estonian Tax and Customs Board if the expense is business-related.

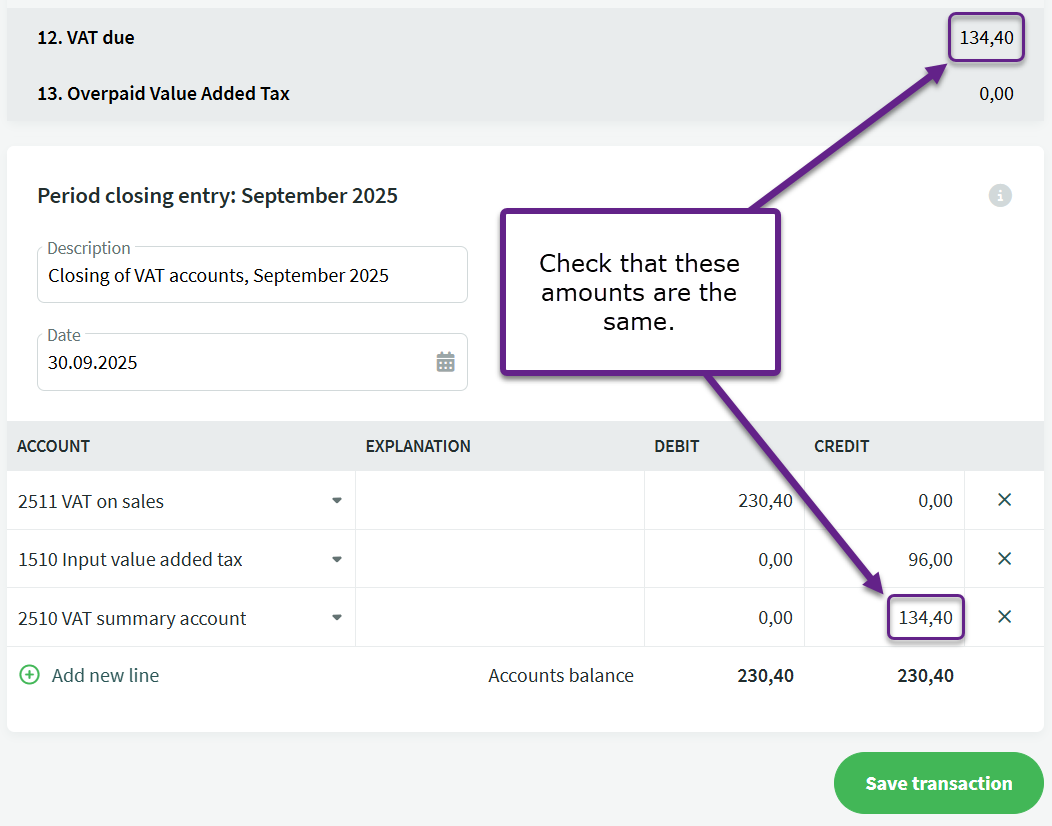

On the VAT statement, the calculation is as follows: output VAT – input VAT = VAT payable (or VAT prepayment).

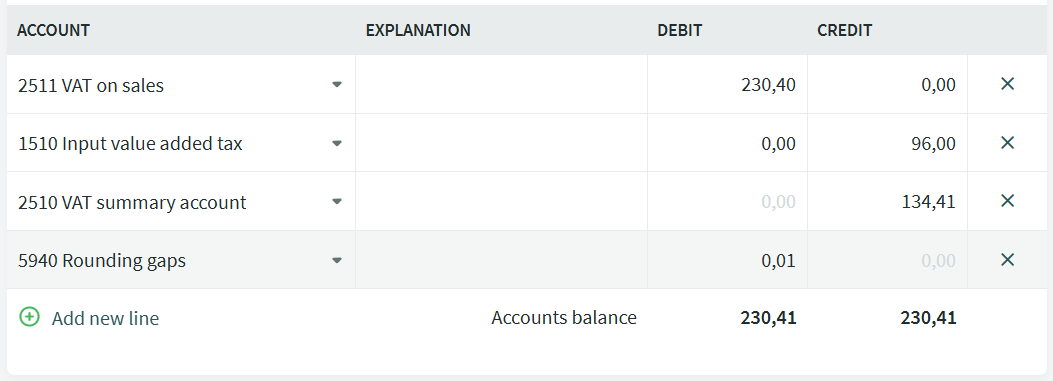

The closing entry can be found under the VAT statement for the respective month. This entry clears the output VAT and input VAT accounts, and records the VAT amount payable or overpaid for the period on the VAT summary account. ● Sometimes, there may be slight differences between the calculated amounts and the totals in the general ledger entries. In such cases, it is important to ensure that the VAT summary account reflects the same amount as reported in the VAT return submitted to the Tax Authority. The difference should be added to the rounding account (5940 Rounding gaps). In most cases, the system is able to detect the difference and adds the rounding automatically.

With the current VAT rate (24%), the difference may occasionally be up to around 5 euros. The exact amount depends on the number and size of invoices. To verify this, you can export the VAT report (Reports -> VAT report) and use formulas in Excel to check the calculated output VAT totals.

Important The period closing transaction must not be created manually, as this would cause the statement to display incorrect results when verifying the data later.

● If you have made a bank transfer to the Tax Authority’s account after submitting the declaration, you need to enter a financial transaction in the system for this payment. This can be done under Accounting -> Transactions by clicking the New transaction button in the upper right corner of the transaction list, or the transaction can be recorded automatically during the bank import process. ● The offset between the VAT liability and the prepaid tax account is usually processed by the Tax Authority on the tax due date (the 20th of the month). If the payment is made after the due date, the amount will be posted to the prepaid tax account upon receipt. To reflect this transaction in SimplBooks, an additional financial entry must be made between the prepaid tax account and the VAT summary account.● Additional information on VAT-related transactions can also be found in the guide Frequently used accounting transactions, section 6.

If you have any additional questions, please write to us at support@simplbooks.ee

Leave A Comment?