When implementing the SimplBooks accounting software, initial balances must be entered for both new and existing businesses. Until at least one account has an initial balance entered, no entries can be made. If the initial balances are unknown or all are zero for any other reason, at least one account must still have an initial balance entered, with the amount marked as zero.

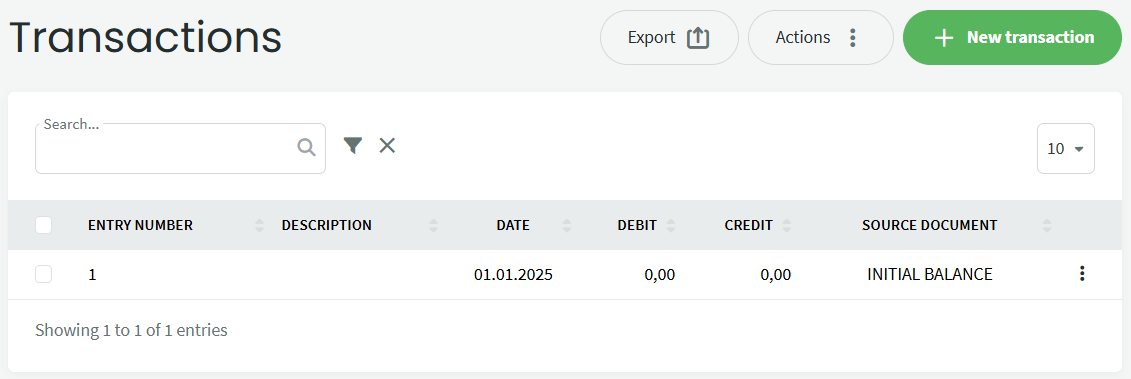

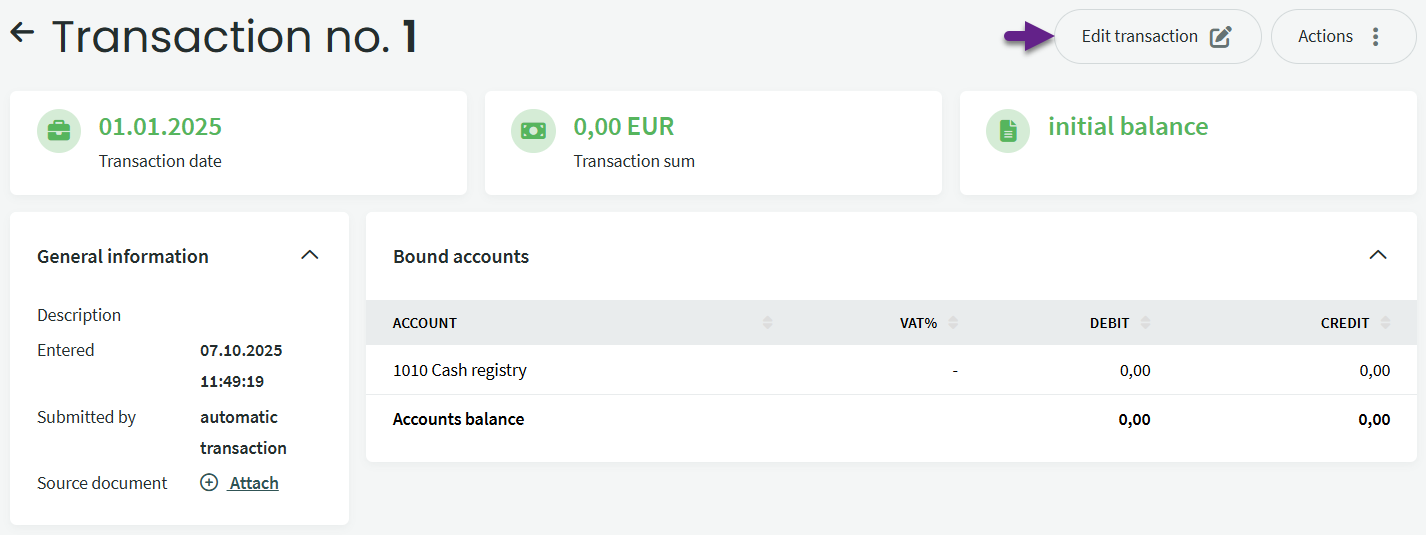

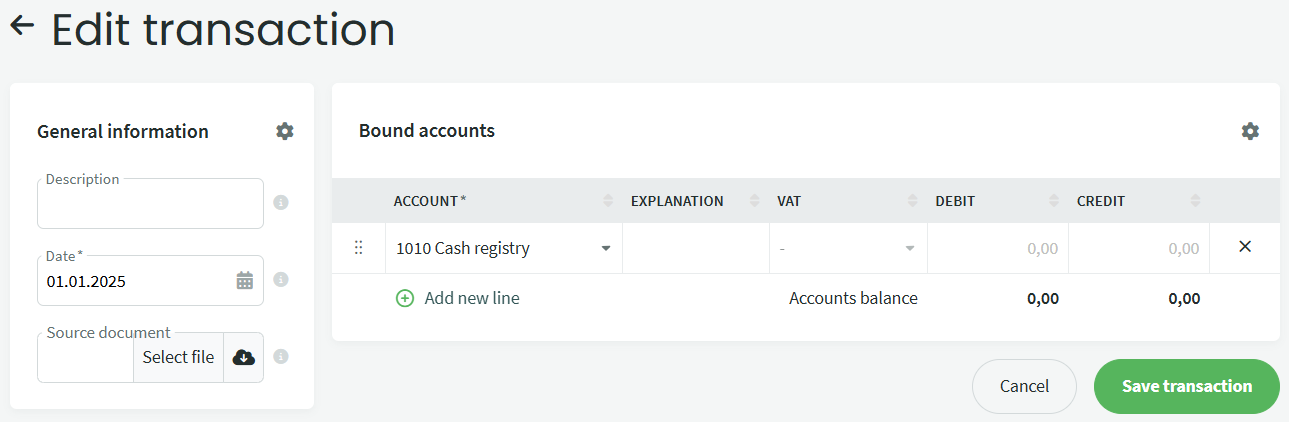

1 When creating a company in the SimplBooks environment, the system automatically adds an initial balance entry. You can find this entry under Accounting -> Transactions, where the “Source document” column will show the information “INITIAL BALANCE”. 2 Click on the entry line, and in the opened view, select “Edit transaction“. 3 Review and adjust the initial balance date as appropriate. For an existing business, set the initial balance date based on when you want to start accounting in SimplBooks. Filling out the description field is not mandatory, but it is recommended to write “initial balance xx.xx.202x” there. 4 If an existing business starts working in SimplBooks in the middle of the financial year, it is reasonable to begin on the first day of the month. Therefore, the initial balances should reflect data as of the last day of the previous month (e.g., if work starts on September 1, 20xx, the initial balances should be based on data as of August 31, 20xx). 5 When starting work in the middle of the financial year, both the balance sheet and profit and loss statement account balances must be entered. ● You should not enter a balance for account 3700 Net profit/loss for financial year in the initial balance entry. This result is calculated based on the balances of revenue and expense accounts. 6 When starting work at the beginning of the financial year, the initial balance date should be the start date of the company’s financial year. If the financial year differs from the calendar year, corresponding adjustments must be made in the environment settings. 7 At the beginning of the financial year, only the balances of balance sheet accounts are entered as initial balances. At the end of the financial year, the annual profit is reflected on a separate line. When entering the initial balance transaction, sum the profits/losses from previous periods and the profit/loss for the reporting year, and enter this amount in SimplBooks under account 3600 Retained profit/loss. 8 To add a line for a new account, click the “Add new line” button, select the appropriate account, and enter the amount. 9 You can also save the initial balance transaction as out of balance and continue to add account balances until everything is accounted for and the transaction is balanced. 10 SimplBooks does not allow you to enter amounts with a minus sign. Instead, enter the amount on the opposite side of the account. For example, if you’re noting the accumulated depreciation amount for fixed assets, mark it on the credit side of the account, and this amount will correctly appear as a negative in the balance sheet. ● The balances of all accounts are entered into one initial balance transaction. Once all the balances of the accounts used in the previous period are entered, the initial balance transaction must be balanced; this is a prerequisite for the balance sheet to be balanced.Next you should enter the following items included in the initial balances:

1. Transferring claims and liabilities of previous periods to SimplBooks

2. How to bring your existing assets over to SimplBooks?

3. Entering initial warehouse inventory

If you have any additional questions, write to us at support@simplbooks.ee

Leave A Comment?