In order to add improvement related costs to the purchase price of the fixed asset, you will need to adjust the acquisition cost of the fixed asset.

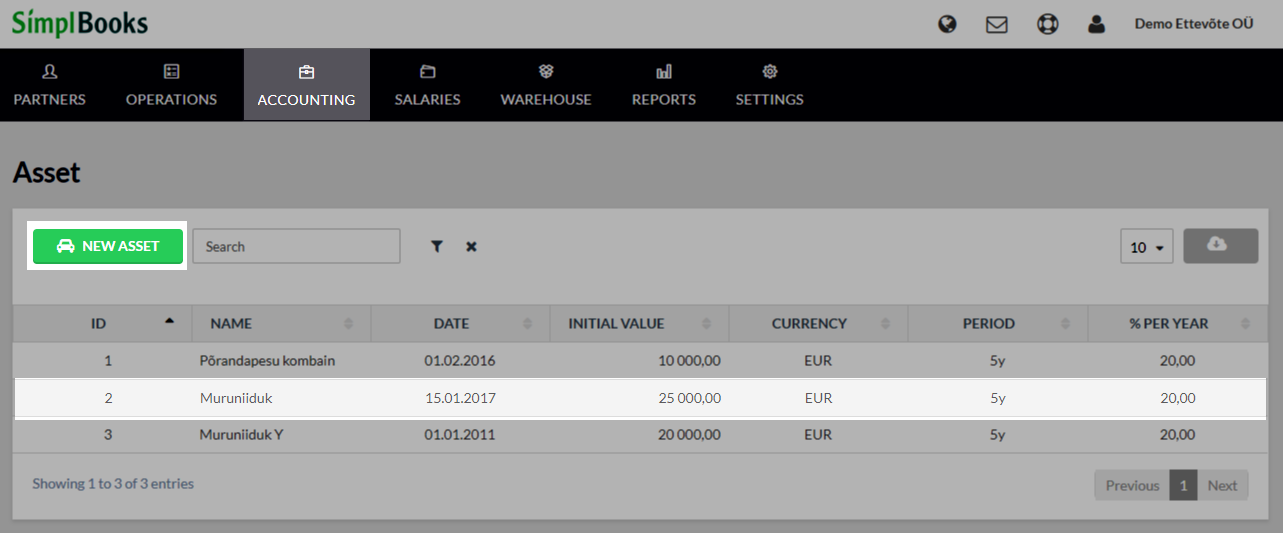

To do so, move within the menu Accounting -> Fixed asset, find the necessary fixed asset and open the fixed asset information sheet by clicking on the corresponding row.

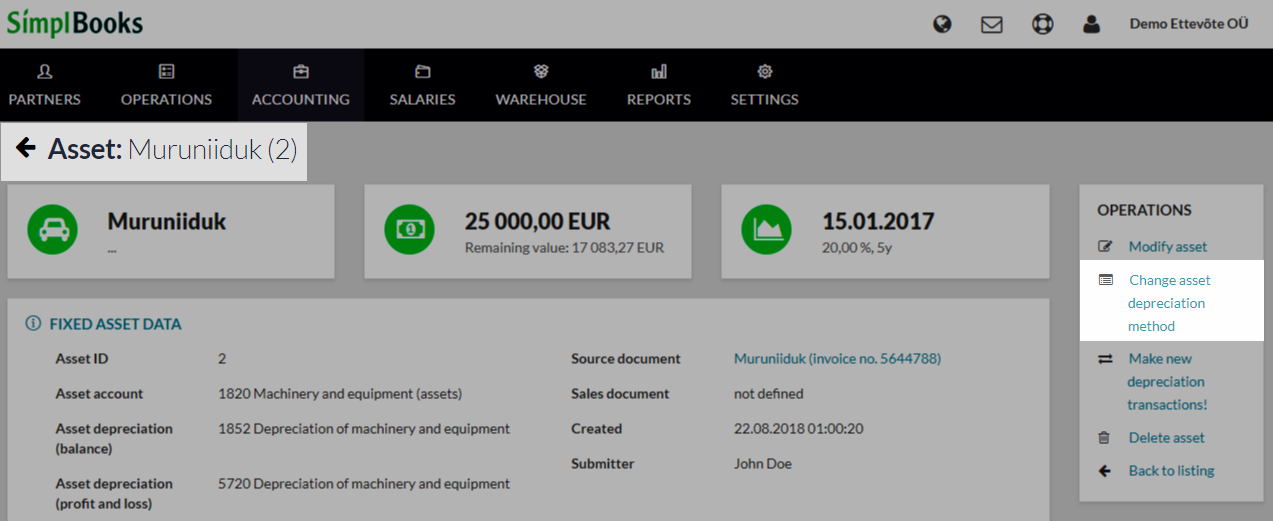

Next, select from the menu to the right: Operations -> Change asset depreciation method.

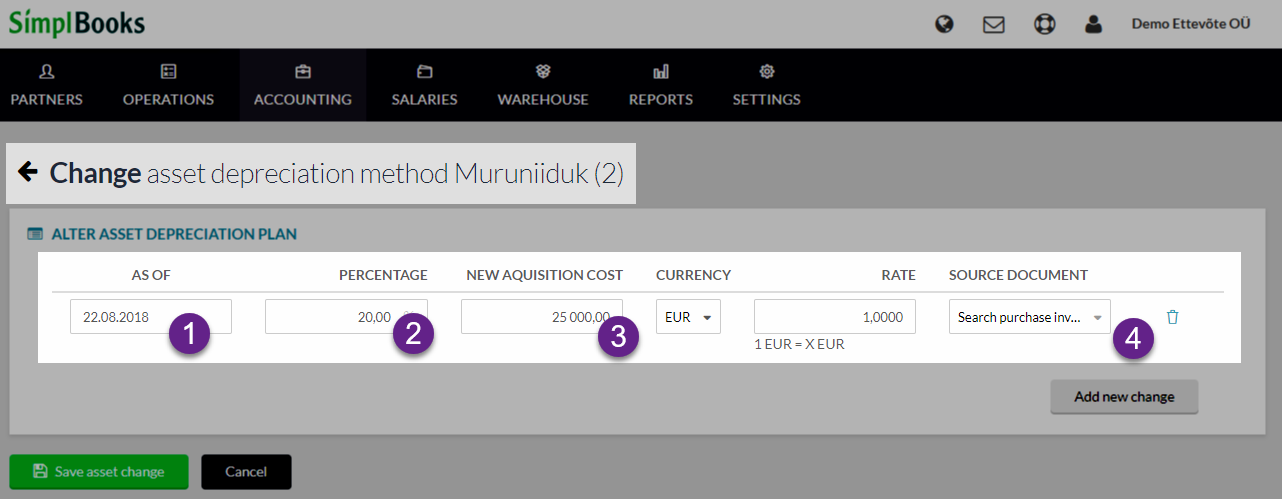

After doing so, a view for entering and viewing changes to fixed asset calculations opens. In case the changes entered previously to the fixed asset are missing from the calculation, then one change with today’s date will be displayed in the window that opens. If you do not want to add the changes or change them, click on the button “Cancel“.

- Starting – from the date of application of the change

- Percent – depreciation percentage that becomes valid starting with the moment of the change

- New acquisition cost – new acquisition cost valid from the moment of the change. Add the costs associated with making improvements to the value of the fixed asset, i.e. the acquisition cost for the fixed asset and add the total sum here (initial acquisition cost + improvement cost)

- Source document – it is now also possible to associate the fixed asset improvement with a specific purchase invoice row

Save the changes by clicking on the button “Save fixed asset change”.

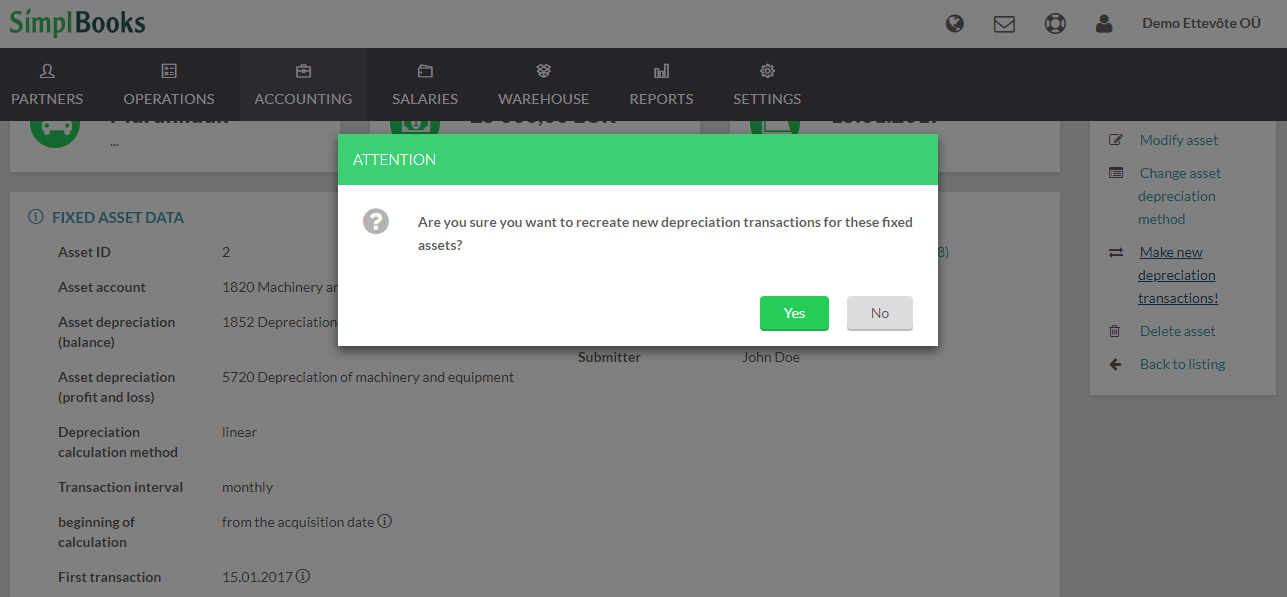

Please note! In the event that the improvement of the fixed asset takes place on a date that is in the past, then new depreciation entries must be prepared for the fixed asset.

- Operations -> Prepare new depreciation entries.

- Select “Yes”.

The system will prepare an automatic financial entry regarding the increase in the acquisition cost of the fixed asset, which will be reflected in the balance sheet as well as the income statement.

Credit: 5xxx Depreciation of the fixed asset and the impairment of its value

Debit: 1xxx Fixed asset accumulated depreciation

The entry and reflection of the decrease in value of the fixed asset takes place analogous to the previous, in the case of the reduction of a new acquisition cost a reverse entry to the previous entry will be prepared regarding the fixed asset calculation change row.

Debit: 5xxx. Depreciation of the fixed asset and the impairment of its value

Credit: 1xxx Fixed asset accumulated depreciation

In the event that the value of the fixed asset does not increase or decrease, with the only change being to the depreciation rate, then an additional automatic entry for the change to the calculation of the fixed asset will not be prepared.

Leave A Comment?